Almost entirely reliant on imported fuel, Taiwan’s energy sector and electricity generation is correspondingly vulnerable to outside influence and disruption. However, fuel imports are not the only concern for Taiwan’s energy security—the state of the electric grid itself also exposes Taiwan to additional risks. This article will discuss the conditions of Taiwan’s electricity grid during Taiwan’s green transition, its implications for energy security, and the main challenges and opportunities going forward.

Background

As concerns about climate change and related environmental degradation have grown, countries around the world have begun to look for lower-carbon alternatives to the status quo. The Paris Agreement, adopted in 2015, sought to codify this impetus towards a low-carbon energy transition by establishing a framework of nationally determined contributions (NDCs). Achieving these NDCs, however, presents significant challenges for each government’s policy design and implementation. In this effort, Taiwan is no exception –facing both challenges shared by other transitioning economies and those unique to Taiwan.

The conversation about Taiwan’s energy mix began long before the Paris Agreement and has been animated by a variety of concerns and voices. Of the most visible of these has been an anti-nuclear movement that has played a decisive role in Taiwanese politics—from shaping party platforms to delivering electoral victories. The Democratic Progressive Party (DPP) and the New Power Party (NPP) have both included de-nuclearization in their party platforms and called for increasing the share of the island’s renewable energy generation. This has somewhat centered the debate about Taiwan’s energy transition on fuel switching itself, particularly as it relates to Taiwanese citizens’ concerns about the harmful effect of poor nuclear waste management or about the risk that natural disasters pose to nuclear power infrastructure and their surroundings. However, a transition away from nuclear power does not necessarily mean a transition to renewable energy; without the right policy measures, a transition towards increased fossil fuel use is more likely. Moreover, the different pathways of transition away from nuclear power each have their own implications for concerns beyond those of the anti-nuclear movement.

Energy transition choices for Taiwan will also have significant impact on the island’s environmental conditions, carbon emissions, economy, and security concerns. Moreover, transformation of the fuel inputs to electricity generation can only contribute a certain share of the system’s resilience—for durable security of the electricity sector, reforms must also address challenges and opportunities for the electric grid itself.

Current state-of-play of Taiwan’s electric grid

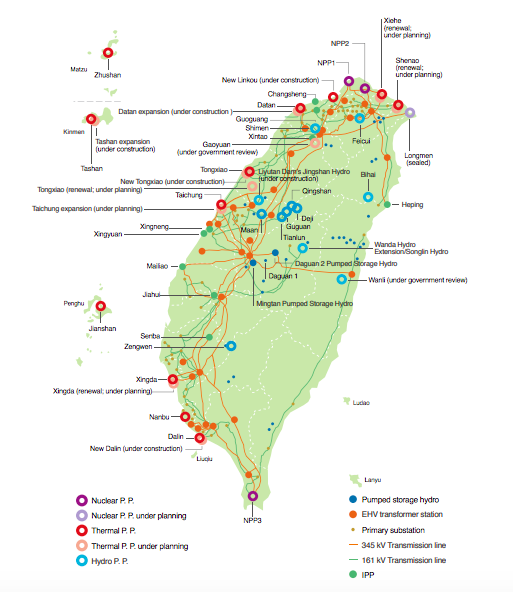

In mid-2017, Taiwan’s nine independent power producers offered only 7 GW of generation capacity, while Taipower owned the vast majority of capacity (over 30 GW) and the transmission and distribution power grid. Taipower’s 2017 sustainability report illustrates the geographic concentration of generation facilities and transmission lines:

Figure 1. Taiwan’s Power Plants and Power Grid (Taipower, 2017)

Taiwan’s New Energy Vision Plan covers four fronts: 1) a nuclear-free Taiwan by 2025, 2) increasing the share of renewables to 20 percent of total electricity generation by 2025, 3) expanding natural gas use, and 4) completing “revision of the Electricity Act to facilitate energy transformation.” New generation facilities will need to be connected to the existing electrical grid and, for offshore wind power generation, via submarine cable. In 2016, the Executive Yuan established an Energy and Carbon Reduction office to assist the Ministry of Economic Affairs (MOEA) to implement its two-year solar promotion plan, which includes an instruction to “[s]trengthen electric grid planning: draft a construction plan for the transmission and distribution of renewable energy that includes distribution and transmission plans, and plans for enhancing power grid facilities to resolve feeder-line issues.”

Amendments to Taiwan’s Electricity Act passed in early 2017 were intended to liberalize the renewable energy market, permitting independent clean electricity generators to sell electricity to customers, rather than the state-owned Taiwan Power Company utility (also known as Taipower), and at rates based on a favorable feed-in tariff. Power and transmission is state-run, but the electricity sales mechanisms allow customers to purchase electricity from renewable energy generators. The amendments instruct the central government to designate a regulatory agency to supervise the electricity market, including establishing an “energy price stabilization fund to minimize price volatility” and regulatory controls for public power sales enterprises.

Only after the passage of the second-stage amendments, however, will customers be able to purchase electricity directly from private-sector plants. According to the amendments, “within one to two-and-a-half years after the passage of the first-stage draft amendments,” complete liberalization should be achieved and previous restrictions on renewable energy sales to be lifted. Also, “within six to nine years,” Taipower would be “transformed into a holding company” and two subordinate companies would be established to manage power generation and, separately, transmission and distribution. At the same time, communities, local governments, and other groups will be permitted to establish renewable energy enterprises to create a “localized, decentralized, community-based electricity industry” and to diversify energy supply.

In 2017, MOEA’s Bureau of Standards, Metrology and Inspection established the Taiwan Renewable Energy Certification Center to coordinate its new responsibilities over Taiwan Renewable Energy Certification (T-REC). Some international corporations are already procuring T-RECs in order to reduce their scope 2 emissions (defined as those from purchased or acquired electricity, steam, heating, and cooling), but others are waiting to see how the larger-scale power purchase agreement (PPA) market will develop. One method of procuring T-RECs allows private companies to build and operate their own on-site renewable energy projects. The degree to which these are connected to the broader grid will determine the impact of correspondingly reduced corporate demand for Taipower electricity; for example, grid-tied direct supply incurs only power wheeling fees, while non grid-tied direct supply does not incur power wheeling fees, dispatch fees, nor service fees.

Implications for energy security

Threats to the security of the electric grid range from the commonplace—including damage from small animals, extreme weather, and attack or error by individuals—to the exceptional—including supply chain disruption, coordinated physical and cyber attacks, or even nuclear explosions and accompanying high-altitude electromagnetic pulses. It is important for Taiwan to consider the following: first, how China might take advantage of or even weaponize these threats to escalate conflict; and second, how to reduce Taiwan’s vulnerability to these threats in that context.

In August 2017, six of the generators at Taiwan’s largest natural gas-fired power plant failed, creating hours-long blackout for almost 7 million households all across the country and causing then-Minister of Economic Affairs, Lee Chih-kung to resign. Just days earlier, he had told reporters that “the power grid’s exposure risk is greater than that of power plants during natural disasters. […] We have asked Taipower to propose improvement plans.”

Taiwan’s current electricity grid still relies primarily upon state-run Taipower, which is still at the beginning of implementing the above-mentioned reforms. The amended framework of the electricity market will allow for greater consumer choice and competition between power generation companies. Opening the renewable energy generation market has already attracted foreign companies to participate in new projects in Taiwan, particularly in the offshore wind sector, although financing challenges remain.

Challenges and opportunities going forward

As Taiwan works towards the dual goals of phasing out nuclear power generation and incorporating more renewable energy generation, the electrical grid must adapt accordingly. According to the Bureau of Energy’s annual reports, in 2017, renewable energy sources and pumped hydropower storage accounted for 15.8 percent of Taiwan’s installed capacity but only 5.8 percent of its electricity generation for that year. As these sources begin to account for an increasing share of capacity, their full integration onto the grid will become increasingly important.

Some of the reform measures that the Taiwanese government is taking is an all-hands-on-deck approach to the challenges of meeting its twin fuel transition targets. For example, the Green Energy Roofs program seeks to recruit the public to contribute to renewable power generation, offering a 3 percent subsidy for those who install rooftop solar PV on their homes. Paired with energy storage, this kind of distributed generation could provide valuable resiliency to the residential electricity sector.

Most of the power supply warnings that Taipower has issued in the past 20 years have been due to disruptions to the power grid rather than to generation. One solution would be to add new circuits to the high-voltage towers; another would be to pivot towards more local generation, reducing the load on long-distance transmission lines. Civil society organizations in Taiwan, notably the Homemakers United Foundation, have advocated for investments in distributed generation, including community cooperatives. Other measures, including smart- and microgrids, building and energy efficiency, and demand response have the potential to help reduce the burden on long-distance transmission lines.

Conclusion

Natural gas is oft-cited as a potential bridge fuel between the status quo mix and a higher share of renewable generation. Because of its peaking capabilities, this fuel could help mitigate some of the challenges posed by increasing integration of intermittent sources. However, its contribution to energy security in the short term is limited. Moreover, this is still a stopgap in a long-term decarbonization trajectory that will ultimately require new innovations, such as smart grids and metering. A sustainable and secure electricity grid with Taiwan’s preferred distribution of fuel inputs will require significant investments in grid infrastructure, innovative management approaches, and an emphasis on local level engagement.

The main point: Denuclearizing Taiwan’s electricity sector without also diversifying generation sources could exacerbate Taiwan’s energy insecurity challenges. Diversifying Taiwan’s electricity sector without decarbonizing fuel inputs increases the risks of stranded assets and negative environmental consequences. A sustainable and secure electricity grid with Taiwan’s preferred distribution of fuel inputs will require significant investments in grid infrastructure, innovative management approaches, and an emphasis on local level engagement.