For many, US trade policy under the Trump Administration has become a challenge to navigate. On July 31, the Trump Administration announced that imports from Taiwan will be subject to a 20 percent tariff starting as early as August. This will apply to goods that were, until recently, eligible for de minimis (imports valued under USD 800) treatment, but excludes certain sectoral goods like automobiles and metals that have higher tariff rates. Meanwhile, there are exemptions for semiconductors and personal electronics.

Most of the goods that Taiwan exports to the United States are still exempt from this new tariff (following sectoral exemptions made in April), but this could change at any moment. At the time of writing, President Trump has already signaled new tariffs on semiconductor products, which could be announced soon and could reach as high as 100 percent.

The recent 20 percent reciprocal tariff announcement creates a number of challenges for Taiwan and its companies. First, while 20 percent is lower than the 32 percent tariff originally threatened by the Trump Administration, it is still much higher than what American importers are used to paying. It will also be slightly higher than the 15 percent reciprocal rate President Trump negotiated with neighboring countries like Japan and South Korea. This puts small and medium-sized Taiwanese companies at a cost disadvantage when compared to their regional competitors.

While many in Taiwan may be critical of the Trump Administration’s trade policies, nearly every foreign government is grappling with their own set of US tariffs. Even American allies with which the United States enjoyed large trade surpluses are now facing new tariffs on their exports.

There are still opportunities for the Lai Administration to strike a deal with the Trump Administration, but the reality is that Lai Ching-te (賴清德) may not be able to secure a much lower tariff rate than 15 percent. Meanwhile, high demand in the United States for the construction of artificial intelligence (AI) data centers continues to inflate the US trade deficit with Taiwan.

And as President Trump has made clear many times, he does not like trade deficits.

Decoding the Trade Laws

Recent tariffs by the Trump Administration can be generally separated into two categories: reciprocal tariffs and sectoral tariffs. The distinction between these two categories mostly comes down to which law the Administration uses to enact the tariff.

The Administration applies reciprocal tariffs through the use of the International Emergency Economic Powers Act (IEEPA). The reciprocal tariff rate of 20 percent is applied to all imports from Taiwan except for goods that are under exemption or those subject to sectoral tariffs. Alternatively, President Trump applies sectoral tariffs via the Trade Expansion Act of 1962—following a Section 232 investigation stipulated by the Trade Act.

Sectoral tariffs are generally narrow and apply to specific goods like steel or automobiles but the Trump Administration has initiated over a dozen Section 232 investigations (including those from the first Trump Administration) covering a wide range of goods including: semiconductors, semiconductor manufacturing equipment, automobiles, automobile parts, critical minerals, pharmaceuticals, steel, aluminum, copper, and several other products. Not all Section 232 investigations have resulted in tariffs yet. Presently, Section 232 investigations have led to a 25 percent tariff on imports of automobile and automobile parts, and a 50 percent tariff on steel, aluminum, and copper.

Timeline of US Tariffs on Taiwan

America imports a wide variety of goods from Taiwan, buying over USD 116 billion worth of goods in 2024. Most of these products were computers, computer accessories, and semiconductors. On April 2, the Trump Administration threatened to place a 32 percent reciprocal tariff on imports from Taiwan. On April 9, that rate changed to 10 percent to allow Taiwan and other countries time to negotiate a trade deal with the White House. On April 11, the White House then exempted many technologies from these tariffs, including smartphones, computer parts, and servers.

US Imports from Taiwan, 2024 | ||

Goods under April 11 tariff exemption | USD 73.9 billion | 64% |

All other imports | USD 42.4 billion | 36% |

Total imports from Taiwan | USD 116.3 billion | 100% |

Table: US Imports from Taiwan, 2024. (Table Source: Author, US Census Bureau trade data)

Because of the April 11 exemptions, more than half (64 percent, based on 2024 data) of the goods imported from Taiwan are still exempt from tariffs, including the new 20 percent reciprocal tariff announced on July 31.

Last year, the United States also imported USD 2.2 billion worth of screws, bolts, nuts, and similar articles (HTS Code 7318), USD 1.9 billion worth of motor vehicle parts (HTS Code 8708), and USD 1.5 billion worth of electrical transformers and power supplies (HTS Code 8504) from Taiwan. These items are not exempt and will either face a 20 percent reciprocal tariff, a 25 percent sectoral auto tariff, or a 50 percent sectoral steel tariff, depending on the specific product.

Neighboring countries like China, Japan, and South Korea are also major exporters of many of these goods. While goods coming from China are subject to an especially high tariff rate, countries like Japan and South Korea have negotiated lower reciprocal tariff rates than Taiwan. In addition to the burden of the tariffs alone, this relative disadvantage puts additional pressure on Taiwan’s cost-sensitive small and medium sized companies.

The Politics of Trade

The Trump Administration’s new trade policy has posed major challenges for all foreign governments. The Lai Administration is no exception. As President Trump has remarked, he believes all countries, “friend and foe alike,” have been ripping off the United States through unfair trade. But, instead of countering his tariffs, such as by raising duties on American exports, most governments have decided to try for a trade deal instead.

Negotiators from Taiwan have met with US officials several times over the last few months. They have no deal yet to show for it. Given that Taiwan’s 20 percent tariff rate is higher than Japan, South Korea, or the European Union’s 15 percent, Lai and his negotiating team are under pressure. However, Trump stated that the relatively advantageous 15 percent rates are a consequence of the multi-billion dollar investment commitments made by these trade partners.

At this point, the Lai Administration has not publicly committed to any major new investments in the United States, nor any significant removals of tariff and non-tariff barriers to US exports to Taiwan.

Could the Lai Administration reduce Taiwan’s 20 percent tariff rate to 15 percent if it made these significant and politically-sensitive commitments? Perhaps, but there is no guarantee.

The Trade Deficit Grows

It’s hard to foresee how US trade policy will unfold over the next few years of the Trump Administration. But if there’s one metric that can be used to determine whether trade relations will improve or not, that would be the US trade balance. Unfortunately for US-Taiwan trade, the trade balance is not improving.

The United States buys more goods than it sells to Taiwan. This means that the United States runs a goods trade deficit with Taiwan, and that deficit has increased every year. Last year, the trade in goods deficit with Taiwan was USD 74 billion. This is more than double the USD 30 billion goods deficit between Taiwan and the United States in 2020. The goods deficit with Taiwan for the first half of 2025 is already reaching three-quarters (USD 56 billion) of the USD 74 billion goods deficit recorded last year. Averaging over USD 6 billion a month, this means the goods deficit for 2025 will likely be higher than it was in 2024.

Some of the increase in trade with Taiwan may be a consequence of businesses trying to get ahead of new tariffs by front-loading purchases. But a more likely explanation is the AI boom that is going on in the United States, which the Trump Administration is also actively promoting.

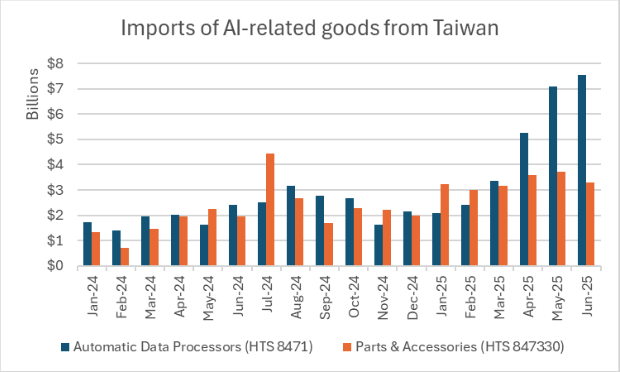

Image: Imports of AI-related goods from Taiwan. (Image Source: Author, US Census Bureau trade data)

The monthly value of AI-related imports from Taiwan has increased nearly 300 percent since January. In June, the United States imported USD 11 billion worth of automatic data processors, parts, and accessories. These are also goods that are currently exempt from tariffs following the April 11 exemption.

Conclusion

US trade policy is not easy for either private companies or governments to navigate. Even as many in Washington champion the importance of Taiwan and US-Taiwan relations, US trade policy continues to complicate even the most important partnerships. Despite this trade uncertainty, there is still opportunity in the US-Taiwan relationship. Whether regarding technology development or defense interests, the relationship cannot be upended because one aspect of the US-Taiwan ties (trade policy) has become a contentious issue.

In April, President Lai published a Bloomberg article titled “Taiwan Has a Roadmap for Deeper US Trade Ties.” In many ways, Lai pitched the same roadmap that other governments have been following to negotiate with the United States. First: recognize that the trade balance is unfair. Second: consider ways to improve the balance, such as removing trade barriers and buying US more goods, from agricultural products to weapons.

In addition to these proposals aimed at addressing the trade balance, Lai also highlighted significant investments already underway in the United States by Taiwanese companies. Furthermore, Lai suggested new ways to partner with the United States on shared interests, such as cooperating on export controls and transshipment concerns.

Many of these proposals are still achievable. In fact, these are the exact measures policymakers would be discussing if foreign relations were not currently so dominated by US trade policy.

The main point: Taiwan’s 20 percent reciprocal tariff rate for exports to the United States puts it at a slight cost disadvantage to neighboring countries such as Japan and South Korea. However, over 60 percent of Taiwan’s imports—such as smart phones and data processors—are currently exempt from tariffs. Despite suffering a higher tariff rate, the Lai Administration has not publicly committed to reducing tariff and non-tariff barriers for US exports, unlike other governments. Whether Taiwan can negotiate for a lower rate will become even more complicated as the US deficit with Taiwan continues to grow.