When young people at the very center of Nigeria’s commercial hub, Lagos, snap photos of pastel-layered milk tea for Instagram, they are partaking in a global trend that originated in Taiwan four decades ago. Indeed, bubble tea studded with chewy tapioca pearls (珍珠奶茶) is more than just a fashionable drink. Far from it, the beverage has evolved into one of Taiwan’s most visible cultural exports, symbolizing how local innovation can achieve global influence. Over the years since its creation in 1986 at the Chun Shui Tang Teahouse (春水堂人文茶館) by Lin Hsiu Hui (林秀慧), bubble tea has become a packaged cultural export with growing supply chains, brand networks, and training seminars—all measured by hard economic data. Today, as boba cafés open in Nairobi, Lagos and Johannesburg, Taiwan’s food culture footprint is gradually expanding across the tapestries of Africa—demonstrating Taiwan’s capacity for soft power, particularly among Gen Z youth.

This analysis examines how bubble tea—also known as “boba” in the United States—has grown from a Taiwanese culinary product into a global industry, now taking firm root some 6,200 miles away in Africa. This expansion highlights Taiwan’s strategic use of cultural entrepreneurship as a diplomatic tool. Given recent economic data on the global market potential for the drink, bubble tea’s role in Taiwan’s broader cultural diplomacy deserves prudent consideration.

A Taiwanese Invention Becomes Global

Bubble tea has evolved into a global beverage catalogue that now supports various ingredient exporters, machine manufacturers, and franchise networks. Its expansion has brought about success for many Taiwanese firms selling vital inputs used in the production of the tea: such as tapioca pearls, flavored powders, syrups and brewing machines. In turn, Taiwanese trade and product exhibitions have actively been promoting the exports of these goods. Profoundly, Taiwan’s cultural identity is tied to the drink. Local coverage has termed this industry the “bubble economy,” illustrating how export has become a feature of Taiwan’s national identity.

Image: Bubble Tea stand in a shopping center in Tomaszów Mazowiecki, Poland. (Image source: Wikimedia Commons)

The global bubble tea industry is measurable. The table below illustrates the current state and projected growth of the bubble tea market in Africa, Taiwan, and across the world.

Market Snapshot

Region (Year) | Source | Market Size |

Middle East and Africa (MEA, 2022) | USD 130 million, projected to reach USD 243 million by 2030 | |

South Africa (2024) | USD 29.31 million, heading toward USD 58.81 million by 2033 | |

Africa (2025) | USD 190 million, expected to hit USD 630 million by 2031 | |

Taiwan (2024) | Taiwan Today [4] | USD 4 billion |

Table: Compiled by the author. Sources: Compiled from [1]–[4] listed in References below.

Why Africa, and Why Now?

Two structural shifts can explain Africa’s growing appetite for Taiwan’s bubble tea. One is the combination of demographic change and urbanization. As Africa’s urban middle classes continue to expand, digitally-connected Gen Z consumers are exposed to new food and café culture. Some market research firms have pointed to the rapid urban adoption of bubble tea in South Africa and the larger East African cities as a reason for the drink’s commercial success.

The second shift is that international supply chains in Africa are steadily maturing. This has resulted in cheaper shipping fees, more foreign ingredient suppliers entering the African market, and local African entrepreneurs opening business relying on imported products. Together, these trends have made bubble tea shops commercially viable beyond Asia and the West.

Meanwhile, bubble tea consumption has successfully become an internet trend on social media. Cafés in metropolitan cities like Lagos, Nairobi, and Johannesburg have pounced on social media to advertise bubble tea using the same pastel aesthetics that typify the product globally.

Taiwan’s Supply Advantage

The authenticity of the drink is not incidental. Taiwanese middlemen supply the crucial ingredients used in making bubble tea, such tapioca pearls, powdered bases, and specialized cooking equipment that are crucial for replicating the “QQ” texture and original taste that consumers expect. To that end, trade exhibitions in Taiwan, including events supported by Taiwan External Trade Development Council (TAITRA, 外貿協會) have helped standardize supply and promote exports of ingredients and machinery. Export figures and news reports indicate substantial revenue in the export of tapioca pearls and related equipment, further supporting the outlook that Taiwan is the industrial home of bubble tea inputs around the world.

In addition to goods needed for bubble tea production, Taiwan’s firms are also providing services such as franchise training, recipe sharing, and equipment maintenance. In such a way, Taiwan’s bubble tea companies are verging on becoming de facto cultural ambassadors.

Local Adaptation and Entrepreneurial Creativity

Where Taiwanese ingredients arrive, African entrepreneurs are adapting to local market demands. In the city of Lagos, vendors like TeaStoria and Bubbletii advertise boba as a premium leisure experience. Meanwhile, in Nairobi, emerging local brands like TAO BOBA style themselves as “authentic vendors” while tweaking sugar levels and mixing in local flavors. Several Nigerian startups even produce tapioca pearls domestically, indicating an early-stage localization of the supply chain for sustainability. Instagram accounts, local listings, and nascent local manufacturers show initial reliance on imported ingredients followed by a gradual shift to local production as capacity grows and customers expand.

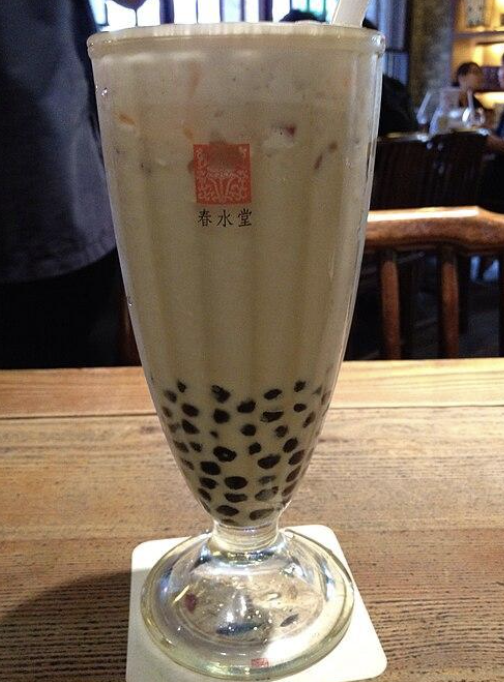

Image: Bubble tea served by Chun Shui Tang Teahouse, the purported creator of the drink. (Image source: Wikimedia Commons)

Because imported pearls and powders can be expensive based on exchange rates and shipping costs, localization is key for the durability of the African bubble tea market. In the longer term, this adjustment appears as a form of co-creation that anchors Taiwanese products within African culture, making soft power look more sustainable than state-led diplomacy alone.

Soft Power in a Cup

Why should policymakers care about the global demand for bubble tea? In simple terms, cultural exports like bubble tea build recognition and familiarity—two intangible assets that friends of Taiwan argue are critical in a diplomatic environment constrained by the People’s Republic of China. For Taiwan, whose formal diplomatic network is slim in the region, these unofficial ties have real strategic value. Bubble tea’s relevance lies in its capacity to create narratives that present Taiwan as innovative, youthful, and modern.

Unlike many other soft power pursuits, commercial logic supports this diplomatic payoff. As the Middle East and Africa markets continue to grow, Taiwanese suppliers and franchise networks may look closer at deepening trade links, creating training exchanges, and cooperating on culinary tourism. Put together, economic and cultural cooperation can amplify Taiwan’s political visibility without requiring any formal recognition from national capitals.

In summary, bubble tea demonstrates how cultural industries can complement official diplomacy by creating bottom-up relationships that give Taiwan an indispensable global image and strengthen its soft power reach, especially in a difficult sphere of African politics.

Policy and Industry Recommendations

Some policy recommendations are necessary for Taiwan’s policymakers and bubble tea exporters to strengthen their relationships with African firms and consumers:

- Expand ongoing trade promotion missions and TAITRA partnerships focused specifically on African retailers and importers.

- Run franchise and barista training for African partners to ensure product quality and brand consistency.

- Commission independent studies capable of tracking cultural penetration, and any correlation with business ties or student exchanges between Taiwan and Africa.

At the same time, some practical recommendations can guide African entrepreneurs as well as policymakers in the industry:

- Entrepreneurs should invest in small food-processing capacities for pearls and syrups to capture domestic value and interest in Taiwan products.

- Policymakers should arrange partnerships with Taiwanese suppliers to provide training and quality control for bubble tea entrepreneurs, and plan incubator programs to help startups scale up their ideas.

Conclusions

The popularity of bubble tea in Africa is not a geopolitical panacea to its diplomatic challenges. Viewed this way, consumer demand will not affect diplomatic recognition overnight. But it is an instructive example of how cultural entrepreneurship can advertise Taiwanese identity, as well as inject industry know-how into an everyday space where young Africans gather, drink and socialize. As African markets expand, the commercial growth of bubble tea will likely open new paths for stronger Taiwan-Africa people-to-people ties. Ultimately, the challenge Taiwan faces is not to overstate the symbolism but to harness it fully.

In the crowded shop of global diplomacy, a cup of bubble tea is a modest expense for a potential cultural footing. For Taipei, whose options for influence are limited or practically invisible, such opportunities are strategically advantageous. That said, the challenges it faces are straightforward: scaling supply chains, localizing production where possible, and measuring diplomatic returns so that policy support gathers momentum. If Taipei solves these growing pains, the next wave of African youth may grow up with a Taiwanese thread woven through their urban lives—one chewy pearl at a time.

The main point: Taiwan’s globally beloved bubble tea has become an emerging bridge of soft power between Taiwan and Africa’s fast-growing urban populations. Fueled by local entrepreneurship and Taiwanese supply chains, a sweeping form of Taiwanese cultural diplomacy is taking shape in African cities. Through tapioca pearls, café culture, and digital aesthetics, Taiwan is extending its global influence beyond just formal diplomacy.

[1] Grand View Research. “Middle East and Africa Bubble Tea Market Size and Outlook, 2030.” Horizon Databook. Accessed October 12, 2025. https://www.grandviewresearch.com/horizon/outlook/bubble-tea-market/mea.

[2] Deep Market Insights, “South Africa Bubble Tea Market Size & Outlook, 2025–2033.” Accessed December 12, 2025, https://deepmarketinsights.com/vista/insights/bubble-tea-market/south-africa.

[3] Mobility Foresights Pvt Ltd. Africa Bubble Tea Market Size and Forecasts 2031. Last updated August 6, 2025. https://mobilityforesights.com/product/africa-bubble-tea-market.

[4] Taiwan Today, “Bubble Economy,” February 6, 2025, accessed December 12, 2025, https://www.taiwantoday.tw/Culture/Taiwan-Review/265324/Bubble-Economy.