Several recent opinion polls have showed that the Democratic Progressive Party’s (DPP, 民主進步黨) candidate Lai Ching-te (賴清德) holds a lead over both Ko Wen-je (柯文哲) of the Taiwan People’s Party (TPP, 台灣民眾黨) and Hou You-yi (侯友宜) of the Kuomintang (KMT, 中國國民黨). However, as it is still six months before the January 2024 election, several factors could significantly impact the election outcome, making current polls irrelevant. Among many uncertainties, Taiwan’s continuing economic downturn is a critical one.

As in past elections, policy towards the People’s Republic of China (PRC) is the main divide between the different political parties in Taiwan. On the economic front, both Hou and Ko contend that better relations with the PRC are key for reviving Taiwan’s economy. Conversely, Lai has argued for the importance of reducing Taiwan’s economic dependence on China, in order to reduce the likelihood of China using economic leverage to undermine Taiwan’s national security.

What Ko and Hou offer is a quick and easy solution to jumpstart Taiwan’s anemic economy. Despite the obvious national security concerns, Lai’s economic diversification approach would necessitate a major adjustment of Taiwan’s external trade and investment relations. Hence, it will be more challenging and time-consuming. It will also require support and collaboration from other countries, most notably the United States. This suggests that Lai’s long-term strategy might not be appealing for Taiwanese voters’ immediate economic concerns.

Explaining Taiwan’s Economic Slowdown

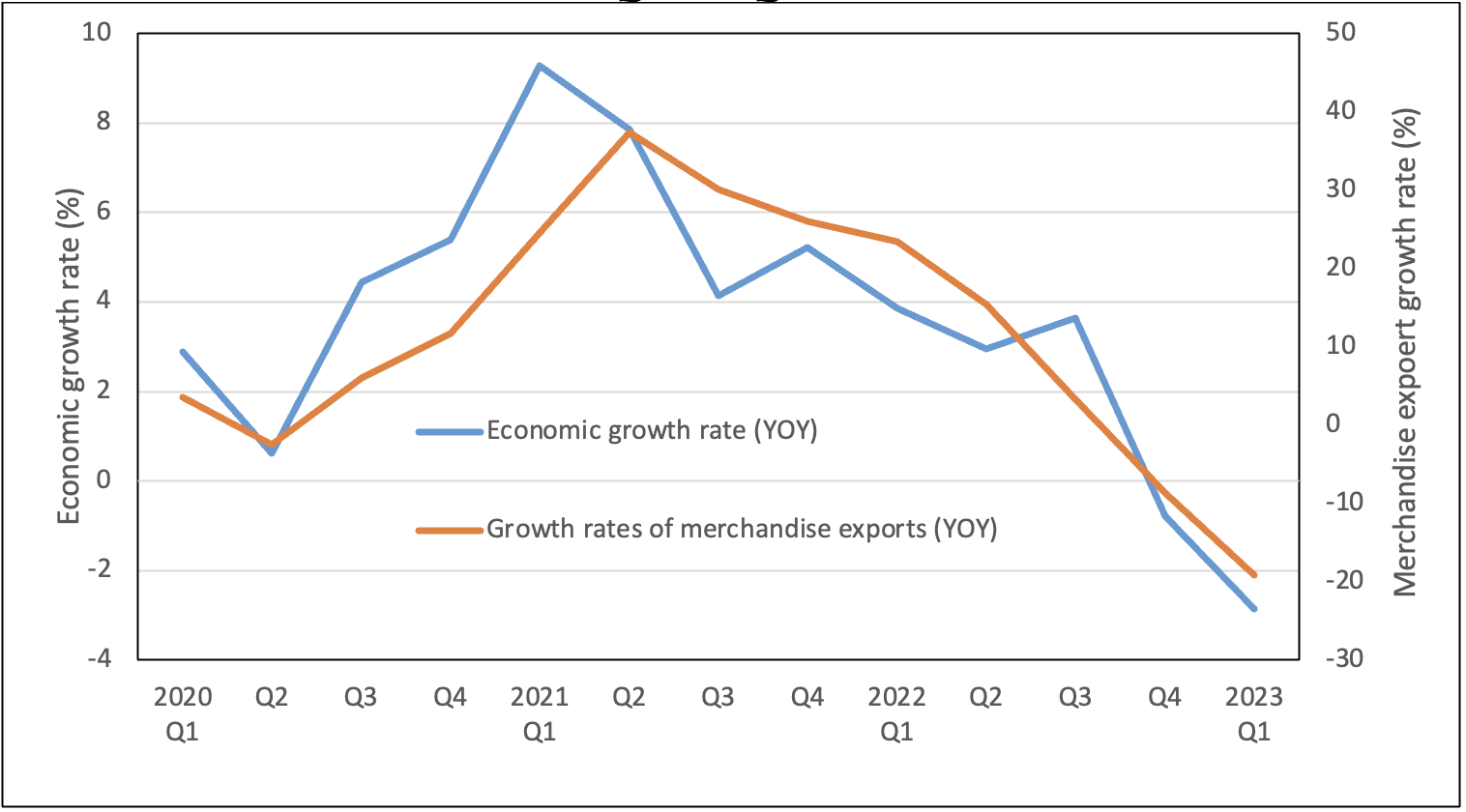

Taiwan’s economic downward trend began in 2021. After the island’s outstanding economic performance during the first year of the COVID-19 global pandemic, its year-over-year (YOY) economic growth rate slowed down sharply: reaching -0.8 percent in the fourth quarter of 2022, down from 5 percent a year before. The economy declined further to -2.9 percent in the first quarter of this year (see Figure 1).

Plummeting exports largely explain this feeble economic growth. Taiwan’s export growth has significantly lost its momentum since 2021 (see Figure 1). According to Taiwan’s Ministry of Finance (MOF, 財政部), in the first half of 2023 Taiwan’s exports to China have registered the largest decline (-26 percent), followed by its exports to ASEAN states (-17 percent), the United States (-15 percent), Japan (-2.5 percent), and Europe (-1.6 percent),

Figure 1: Taiwan’s Economic Growth Rate and Merchandise Export Growth Rate, 2020Q1-2023Q1 (Data source: Directorate General of Budget, Accounting and Statistics [DGBAS, 行政院主計總處])

Softening global demand for final consumption products—due primarily to higher inflation and interest rates—has likely had a substantial impact on Taiwan’s exports of manufactured goods. In addition, Taiwan’s closer economic ties with the PRC have made the small island particularly vulnerable to China’s coercive policies. China‘s own post-COVID economy has been struggling due to sluggish consumer spending, high youth unemployment rates, flagging exports, and a flatlining property market.

More importantly, recent US export control measures, which have restricted the provision of key components and capital equipment to China, could have impacted Taiwanese firms manufacturing on the mainland. Taiwan’s exports of semi-industrial goods to China for final assembly have likely been constrained as a result.

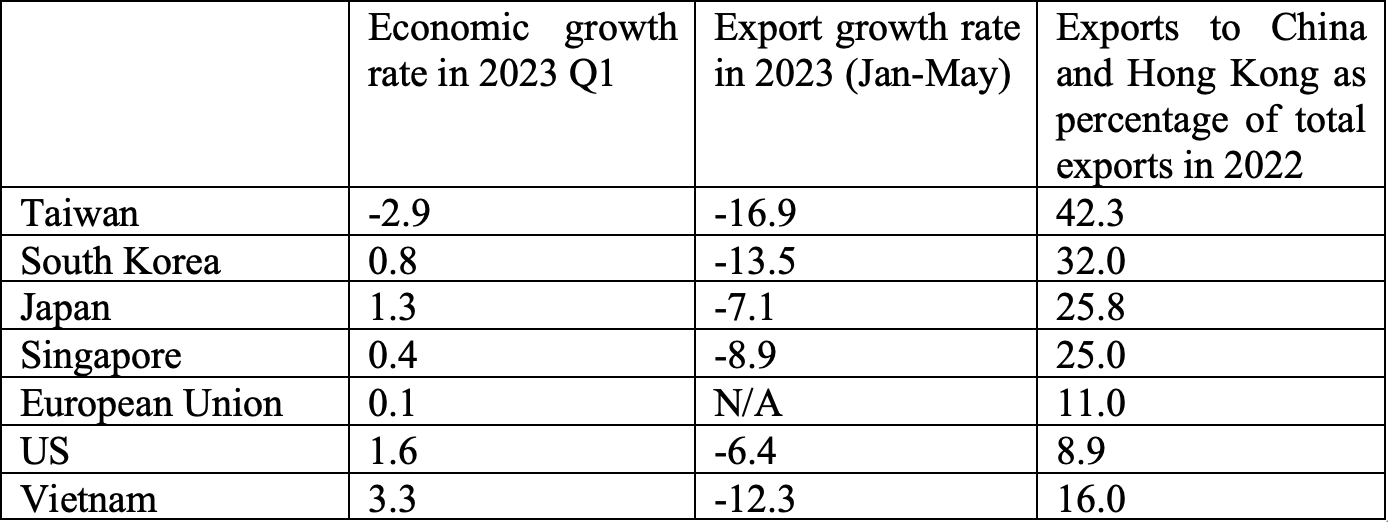

In 2022, 42.3 percent Taiwan’s overall exports went to China and Hong Kong. This percentage is much higher than China’s shares in the total exports of South Korea, Japan, Singapore, Vietnam, the European Union, and the United States. Although those economies also suffered from slowing exports and economic growth rates in the first half of this year, their relatively lower dependence on exports to China has lessened the impact on their overall exports and economic growth.

Figure 2: A Comparison of Taiwan’s Economic Growth Rate, Export Growth Rate, and Export Dependence on China with Major Global Economies. (Data source: Ministry of Finance, Taiwan; DGBAS; Vietnam Customs; Eurostat; Trading Economics https://tradingeconomics.com/)

Figure 2: A Comparison of Taiwan’s Economic Growth Rate, Export Growth Rate, and Export Dependence on China with Major Global Economies. (Data source: Ministry of Finance, Taiwan; DGBAS; Vietnam Customs; Eurostat; Trading Economics https://tradingeconomics.com/)

Economic Polarization as a Key Concern

Beyond stalled economic growth, the growing income gap is another central concern among voters. Taiwan’s official statistics show that household income inequality in 2021 reached its highest level in the past decade. Confirming this, the World Inequality Database reckons that the top 10 percent income group accounted for 48 percent of national income share in 2020, growing from 42 percent in 2000. During the same period, the bottom 50 percent income group’s share dropped from 13 percent to 11 percent.

Although Taiwan raises its minimum wage almost every year, the small nominal wage growth is mostly negated by inflation. For example, in 2022 nominal wage growth was 3.5 percent, only slightly higher than the inflation rate (3 percent). In the same year, over 50 percent of wage earners saw their salary grow at a rate lower than the average growth rate, according to DGBAS statistics.

This limited wage growth can also be observed through GDP by type of income, which includes employees’ remuneration, consumption of fixed capital, and net operating surplus. Over the past several decades, Taiwan’s economic growth has been largely driven by investment in capital equipment, at the expense of stagnating worker remuneration. This is evidenced by the growing share of consumption of fixed capital: from 9 percent of total GDP in 1991, to 16 percent in 2021. During the same period, the shares of companies’ operating surpluses increased from 28 percent to 37 percent, while the share of employees’ remuneration in total GDP dropped from 51 percent to 43 percent, per the DGBAS.

Taiwan’s ongoing exclusion from several multilateral and bilateral free trade agreements (FTAs) is another key factor in its economic polarization. Taiwan’s current bilateral FTA partners only account for a tiny portion of its total trade. However, international trade agreements could have substantial benefits for Taiwan’s economic prospects. This phenomenon has been well demonstrated by the island’s information technology (IT) sector. Thanks to its membership in the International Technology Agreement (ITA) of the World Trade Organization (WTO), Taiwan has benefited from low—or even zero—tariffs on IT trade. As a consequence, the IT-related industry has become Taiwan’s growth engine. Workers in IT-related industries also tend to have above average salaries. In 2022, the average nominal income in electronic manufacturing was 1.6 times the average wage in all sectors. However, the sector only accounted for 8 percent of total employment in Taiwan, according to government figures.

The United States Remains Essential

Taiwan’s current close economic ties with China are partly a consequence of the US policy of integrating China into the global economy over the last few decades. Washington’s opening up of its market to imports from the PRC was an important driving force behind Taiwan’s export-oriented manufacturing investments on the mainland. By sending semi-industrial goods to China for final assembly and then exporting them to the US market through China, Taiwan sustained its economic growth amid the United States’ soft economic policies toward China.

In recent years, the growing US-China rivalry—and perhaps more importantly, the US restrictions on the export of certain high-technology goods to China—have made the cross-Strait production network far less economically viable. In response, international supply chains have increasingly withdrawn from China. In evidence of this trend, since 2019 the United States has seen greater import growth from Taiwan, Vietnam, India, and South Korea than from China, according to the data provided by the US Bureau of Economic Analysis.

These changing production relations can also be seen in Taiwan’s export structure. The share of China and Hong Kong in Taiwan’s total exports declined from 44 percent in 2020 to 36 percent in the first half of 2023. During the same period, Taiwan’s exports to the United States, Japan, Europe, and ASEAN countries expanded from 45 percent to 51 percent of total exports. China and Hong Kong’s share in Taiwan’s total imports also declined slightly, while the United States’ and Europe’s shares grew.

Like the policies that encouraged growing cross-Strait economic integration in recent decades, US policy will continue to play a key role in Taiwan’s future economic relations with China. In turn, this could indirectly influence the island’s economic growth path, as well as its election outcomes.

So far, the Biden Administration has sent very confusing signals with regards to its economic policy toward China. Despite Washington’s harsh restrictions on exporting key components and capital equipment to China, US Treasury Secretary Janet Yellen sought out economic cooperation with China during her recent visit to Beijing. Furthermore, the United States did not include Taiwan in its Indo-Pacific Economic Framework (IPEF), which aims to consolidate the US economic partnerships with its allies in the face of China’s growing influence. The US absence from the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) also decreases Taiwan’s chances to be part of the cross-regional trade deal.

A strong and consistent US economic policy would be a powerful driver for Taiwan’s economic development, and could facilitate the re-designing of its role in the new global economic order. Sustaining Taiwan’s economic development and stability would also be critical to allow the island to support the potential necessity of increased military expenditures in the future. By contrast, a muddled and inconsistent economic policy might re-orient Taiwanese voters toward other options, which might not be in the best interests of the United States or the world.

The main point: Taiwan’s sluggish economy and growing income inequality have added uncertainty to its upcoming 2024 presidential election. To address these economic challenges, Taiwan will need strong US support to expand its international economic space, thus facilitating its further development and economic diversification.